A lot of companies use financial statement software to remove the headache. Looking at the variable expenses, each skincare product needs ingredients to be formulated, some nice packaging, and a good salesperson on commission. Let’s say that our beauty conglomerate sells 1,000 units of its bestselling skincare products for $50 each, totaling $50,000 in revenue. Every dollar of revenue generated goes into Contribution Margin or Variable Costs. What’s left in the contribution margin covers Fixed Costs and remains in the Net Profit / Loss.

Do you already work with a financial advisor?

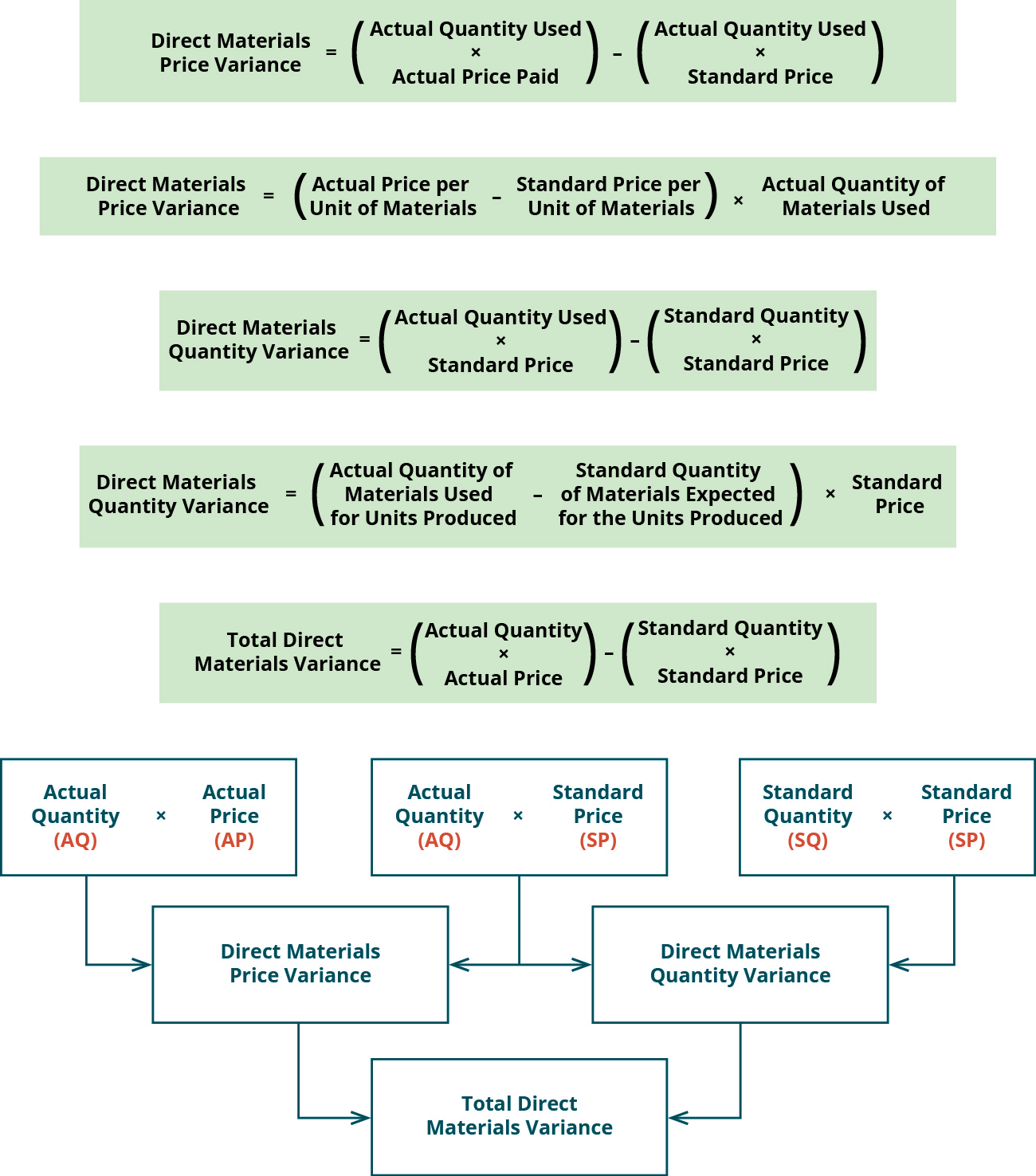

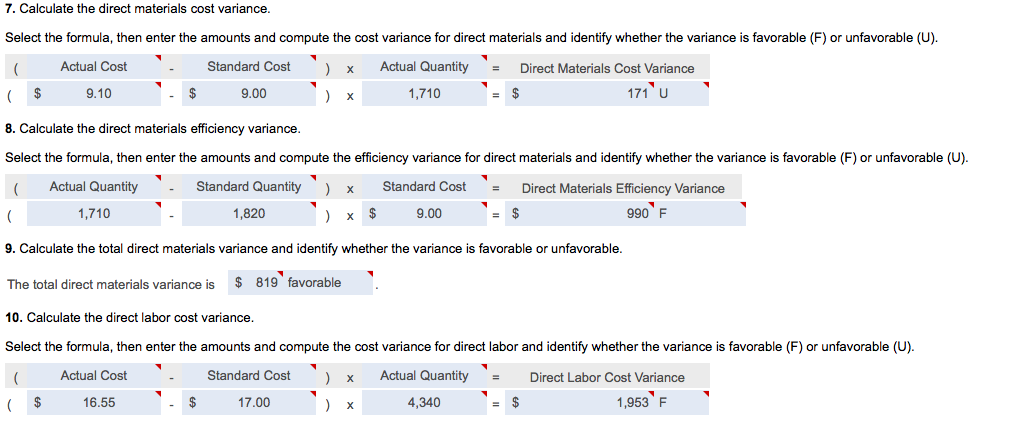

You can find the contribution margin per unit using the equation shown below. This is because the breakeven point indicates whether your company can cover its fixed cost without any additional funding from outside financiers. The following are the steps to calculate the contribution margin for your business. And to understand each of the steps, let’s consider the above-mentioned Dobson example.

Everything You Need To Master Financial Modeling

In other words, contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost. Accordingly, the contribution margin per unit formula is calculated by 3 ways to write a receipt deducting the per unit variable cost of your product from its per unit selling price. The contribution margin represents the amount of revenue left over after subtracting variable costs from total revenue.

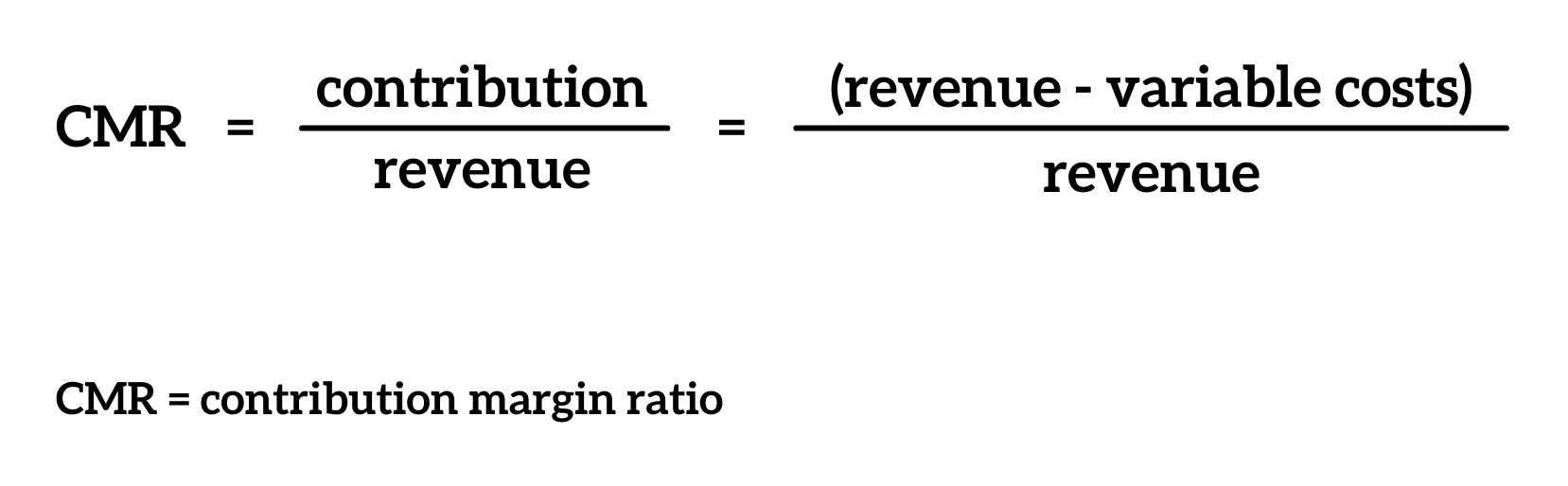

Contribution Margin Ratio

- It serves as a specialized document in financial analysis that strips down revenue into critical components and provides an at-a-glance view of a company’s variable and fixed costs relative to its sales.

- In such cases, the price of the product should be adjusted for the offering to be economically viable.

- Regardless of how contribution margin is expressed, it provides critical information for managers.

- Every product that a company manufactures or every service a company provides will have a unique contribution margin per unit.

- One of the primary benefits of contribution margin analysis is its ability to illuminate the profitability of individual products or services.

This proactive approach to financial management enables timely interventions to steer the company toward its economic objectives. The contribution margin is the amount of revenue in excess of variable costs. One way to express it is on a per-unit basis, such as standard price (SP) per unit less variable cost per unit. It is important to note that this unit contribution margin can be calculated either in dollars or as a percentage.

The difference in treatment of these two types of costs affects the format and uses of two statements. Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior. The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. In our example, if the students sold \(100\) shirts, assuming an individual variable cost per shirt of \(\$10\), the total variable costs would be \(\$1,000\) (\(100 × \$10\)). If they sold \(250\) shirts, again assuming an individual variable cost per shirt of \(\$10\), then the total variable costs would \(\$2,500 (250 × \$10)\). You can’t directly calculate the contribution margin from the EBIT figure, without a breakdown of the fixed and variable costs for each product or service.

By using a calculation, businesses can figure out how much they need to sell to not lose money. The calculation looks at fixed expenses (like the money needed for the shop) and how much each sale contributes after variable costs are paid. This helps businesses plan better, like knowing how many toys need to be sold to pay for the shop and the toy parts. It’s a big part of accounting and helps keep the business running smoothly without losing money.

Looking at contribution margin in total allows managers to evaluate whether a particular product is profitable and how the sales revenue from that product contributes to the overall profitability of the company. In fact, we can create a specialized income statement called a contribution margin income statement to determine how changes in sales volume impact the bottom line. For the month of April, sales from the Blue Jay Model contributed \(\$36,000\) toward fixed costs. To find the contribution margin, we subtract the cost of goods sold (COG) from sales revenue. COG includes the costs directly tied to making a product or providing a service. By doing this, we see the gross profit margin, which helps businesses decide on pricing and how to manage costs to generate more money.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. We’ll next calculate the contribution margin and CM ratio in each of the projected periods in the final step. The greater the contribution margin (CM) of each product, the more profitable the company is going to be, with more cash available to meet other expenses — all else being equal. To calculate the contribution margin, you need more detailed financial data to calculate EBIT.